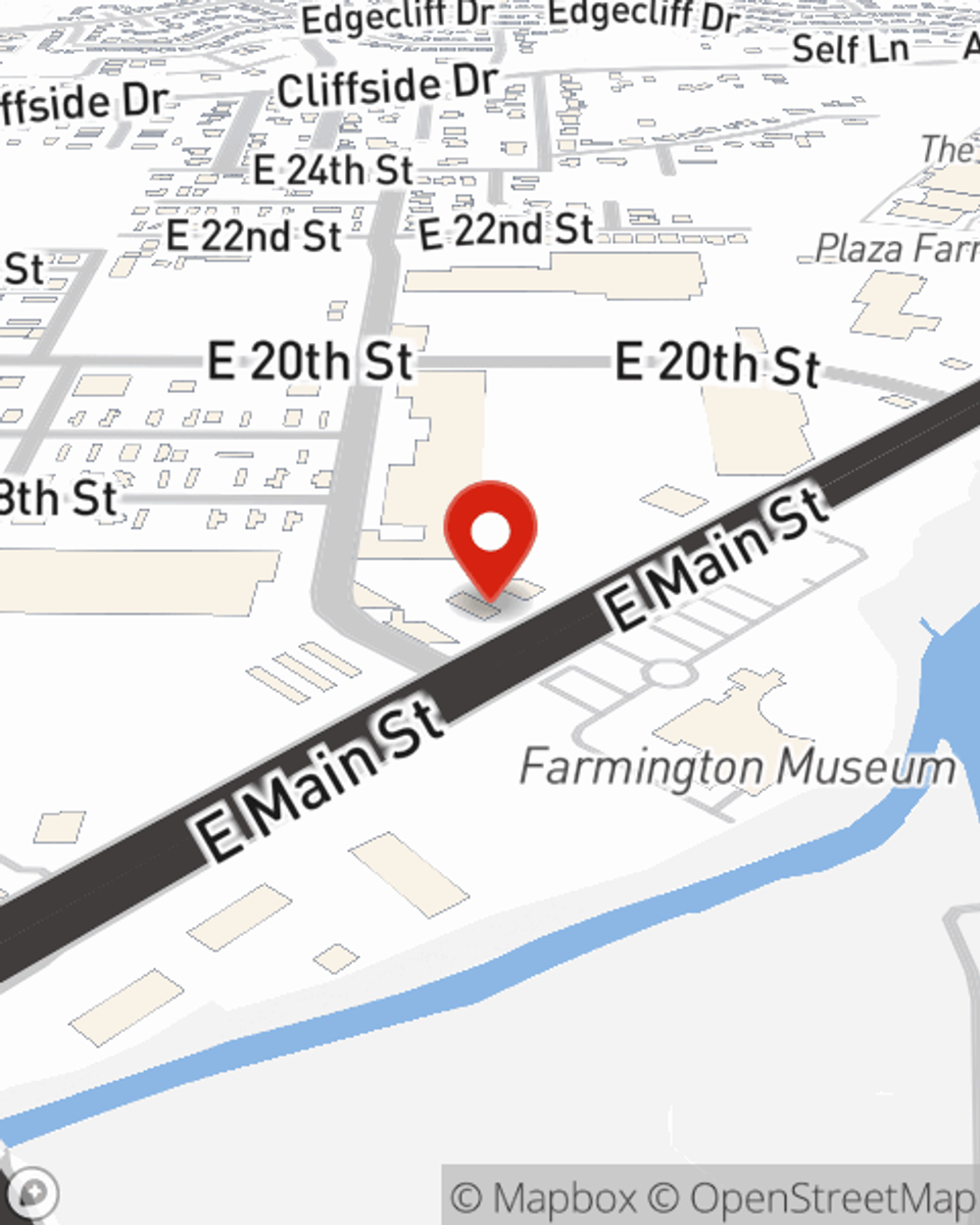

Business Insurance in and around Farmington

Looking for small business insurance coverage?

This small business insurance is not risky

Your Search For Fantastic Small Business Insurance Ends Now.

Whether you own a a pharmacy, a cosmetic store, or a photography business, State Farm has small business protection that can help. That way, amid all the different decisions and options, you can focus on making this adventure a success.

Looking for small business insurance coverage?

This small business insurance is not risky

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, commercial liability umbrella policies or commercial auto.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Ginny Gil's team to discover the options specifically available to you!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Ginny Gil

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.